Ideal Reader:

International-trained nurses new to the U.S. financial system who need guidance on managing their personal finances, including building credit, budgeting, and understanding taxes.

Target:

Nurses looking to gain financial stability and success by learning to manage money, build credit, and navigate financial obligations in the U.S.

Introduction:

- What You Will Learn: This article provides a comprehensive guide to managing personal finances in the U.S., including how to build credit, create a budget, and navigate the tax system.

- Problems It Solves: Eases the financial stress many international nurses face by offering clear, actionable steps to secure financial stability.

Key Questions Answered:

- How do I open a bank account and build credit in the U.S.?

- What steps should I take to manage my personal finances effectively?

- How do I navigate the U.S. tax system?

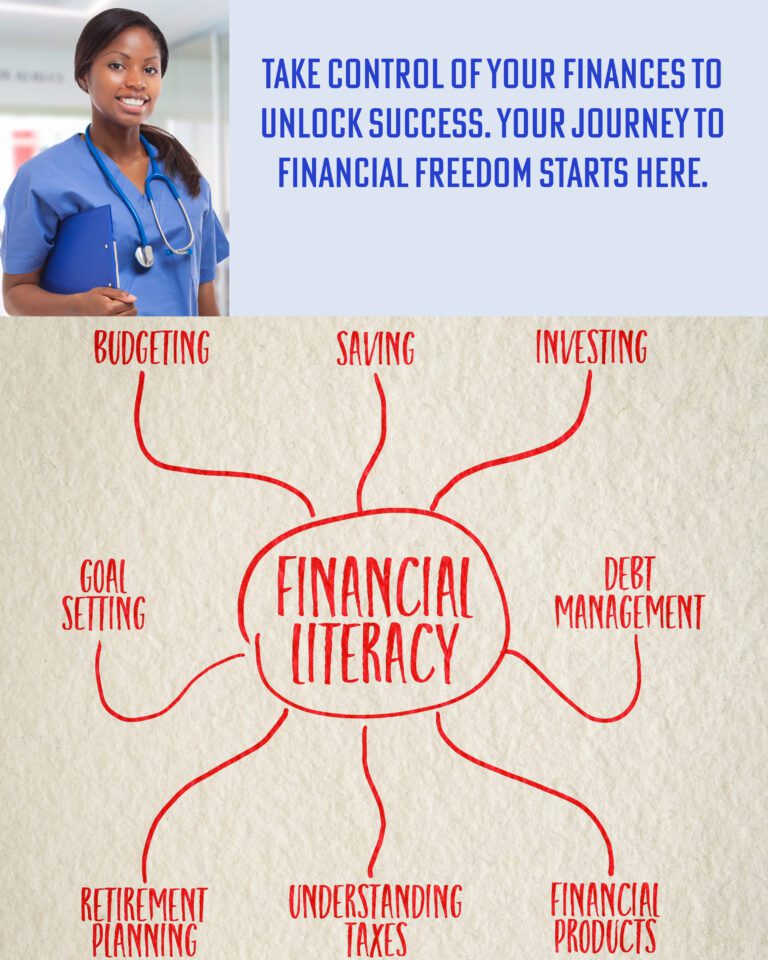

Shifting Focus from Clinical to Financial Preparedness

Challenging Assumptions:

Many international nurses believe they can manage their finances in the U.S. the same way they did in their home countries, overlooking the complexities of the U.S. financial system, including the importance of credit scores, budgeting, and filing taxes (Experian, 2020). Clinical skills are essential, but without financial literacy, international nurses may struggle with issues such as housing, credit, and financial security in the U.S.

Reframing the Idea:

Successfully managing money in the U.S. requires understanding key elements such as credit scores, tax filings, and budgeting. Financial stability is crucial for your personal and professional success, ensuring you can focus on your career without financial stress (Federal Deposit Insurance Corporation [FDIC], 2020).

Insights: Navigating U.S. Finances as an International Nurse

1. Building Credit:

In the U.S., your credit score is a critical factor that affects everything from renting an apartment to securing a loan. Building credit is a top priority for international nurses, and one of the easiest ways to start is by opening a secured credit card. Paying bills on time and keeping your credit utilization low will help improve your credit score over time (Experian, 2020). A good credit score is also vital for long-term financial success, affecting job prospects, car loans, and insurance rates.

Learn more about building credit here.

2. Opening a U.S. Bank Account:

A U.S. bank account is essential for managing your finances. Most banks require identification such as your passport, Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN), and proof of address (NerdWallet, 2020). With a bank account, you can receive your salary via direct deposit, pay bills, and begin building a financial history in the U.S.

Explore how to open a U.S. bank account here.

3. Creating a Budget:

Budgeting is key to managing your expenses effectively. Start by tracking your income and expenses for a month to understand your spending habits. Categorize your expenses into necessities (such as rent and utilities) and discretionary spending (such as dining out or entertainment). This will help you allocate your money wisely and ensure you save for the future (CNBC, 2020).

Learn more about budgeting here.

4. Understanding U.S. Taxes:

Navigating the U.S. tax system can be challenging, especially if you are unfamiliar with the process. As an international nurse, you must file federal and state taxes yearly. Your SSN or ITIN will be required when filing taxes, and you can deduct certain expenses, such as healthcare premiums or retirement savings (Internal Revenue Service [IRS], 2020). Filing taxes properly ensures you stay compliant with U.S. law and avoid penalties.

Discover more about navigating U.S. taxes here.

5. Saving and Investing:

Once you have your bank account and budget, start setting aside money for savings. Emergency funds should cover three to six months of living expenses. Additionally, explore options for investing, such as employer-sponsored retirement plans like 401(k)s or individual retirement accounts (IRAs). These investments help you save for the future and provide tax advantages (FDIC, 2020).

Explore saving and investing strategies here.

Take Control of Your Financial Future

Financial Self-Assessment:

Use a financial self-assessment tool to evaluate your understanding of U.S. financial systems, including credit, taxes, and budgeting. This will help you identify areas where you need more knowledge or support.

Steps to Financial Stability:

- Open a U.S. Bank Account: You can open a checking or savings account by visiting a bank with the necessary documentation (NerdWallet, 2020).

- Apply for a Secured Credit Card: Use a secured credit card to build your credit by paying off balances in full each month (Experian, 2020).

- Create a Budget: Track your monthly income and expenses, then categorize them to develop a budget that ensures savings (CNBC, 2020).

- Learn About Taxes: Familiarize yourself with the U.S. tax system by visiting the IRS website or consulting a tax professional (IRS, 2020).

Overcoming Financial Challenges

Common Objections:

- “I do not have time to focus on personal finances.”

- “Managing U.S. finances seems too complicated.”

Response:

Financial management does not have to be time-consuming or complicated. With simple steps like tracking your expenses, building credit, and filing taxes correctly, you can ensure financial stability and avoid future stress. Breaking tasks into manageable steps allows you to prioritize your finances without overwhelming yourself (FDIC, 2020).

Begin Your Financial Journey

Take Action Today:

Start by applying for a U.S. bank account and securing a credit card. These two steps will help you build a financial foundation. Once your account is set up, track your income and expenses for the next 30 days.

Budget for Success:

Use online budgeting tools or apps to keep track of your spending and saving goals. Regularly reviewing your budget will help you stay on track and make adjustments when necessary (CNBC, 2020).

Visualize Your Financial Success

Imagine a future where you feel financially secure, with a strong credit score, a healthy savings account, and a solid retirement plan. By mastering the U.S. financial system, you secure your personal future and free yourself from financial stress, allowing you to focus on your career and personal well-being. Financial stability is within reach—take the first steps today.

References:

- CNBC. (2020). How to create a budget that works for you. https://www.cnbc.com/select/how-to-create-budget/

- Experian. (2020). How to build your credit score with a secured credit card. https://www.experian.com/blogs/ask-experian/credit-education/improving-credit/build-credit/

- Federal Deposit Insurance Corporation. (2020). Personal finance and investing in the U.S. https://www.fdic.gov/resources/consumers/money-smart/

- Internal Revenue Service. (2020). Guide for filing U.S. taxes as a foreign national. https://www.irs.gov/individuals/international-taxpayers

- NerdWallet. (2020). How to open a bank account in the U.S. https://www.nerdwallet.com/article/banking/open-bank-account-online

Additional Resources :